Sending money to tightly regulated regions has long been a challenge for customers looking to support family, manage expenses, provide financial assistance for medical needs, or maintain financial connections overseas.

When people send money to these corridors, they often face limited payout channels, slower processing times, and fewer reliable options for recipients.

For Australian customers, these challenges become even more distinct when they need to send money from Australia to Chad or the Congo DRC, where access to traditional banking infrastructure can be uneven.

In the Middle East, customers who send money to Jordan, Qatar, or Saudi Arabia may face strict banking requirements that limit flexibility and speed.

Access, transfer speed, and payout choice continue to shape how customers decide where and how to send funds.

MasterRemit’s latest expansion across Africa and the Middle East directly responds to these needs. MasterRemit makes it easier for customers to send money from New Zealand to Chad, Congo DRC, Jordan, Qatar, and Saudi Arabia through one trusted platform by opening new mobile wallet and bank deposit corridors.

This is a major step towards faster transfers and expanded payout options across Africa and the Middle East.

What’s New for Customers in MasterRemit’s Latest Corridor Expansions?

MasterRemit has introduced new corridors that improve how customers transfer funds to both Africa and the Middle East.

The new feature set includes:

- – Fast money transfers to supported mobile wallets and bank accounts.

- – Multi-currency support, including XAF, USD, JOD, QAR, and SAR.

- – Expanded access for customers who previously had limited ways to send money from Australia to Congo, Chad, Qatar, Jordan, and Saudi Arabia.

Newly Available Countries & Services

Africa

– Chad

– Mobile Wallet: Airtel Money

– Supports customers who regularly send money to Chad.

– Congo DRC

– Mobile Wallets: Airtel Money and M-Pesa

– Designed for customers who send money to Congo.

Middle East

– Jordan

– Bank Deposit

– Available for customers who send money from Australia to Jordan

– Qatar

– Bank Deposit

– Supports customers who send money to Qatar.

– Saudi Arabia

– Supported mobile wallets.

– Enables reliable transfers for customers who send money from Australia to Saudi Arabia.

Send Money to Chad with MasterRemit

MasterRemit now enables customers to send money to Chad through a dedicated mobile wallet corridor, expanding access in a market where traditional banking options remain limited.

This makes it easier for Australian customers to send money from Australia to Chad, while helping recipients receive funds directly into their mobile wallets without the need to visit physical locations or rely on cash-based services.

This matters because:

– Many recipients in Chad rely on mobile wallets rather than bank accounts.

– Reduces the need for physical cash collection.

– Enables quicker access to funds for everyday expenses.

These improvements ensure a smoother experience for customers who regularly send money to Chad, while giving recipients greater control over how they access and use their funds.

Send Money to Congo DRC with MasterRemit

Customers can now send money to Congo DRC using mobile wallet transfers that reflect common financial practices in the region. This supports Australian customers who send money from Australia to the Congo DRC and require dependable and easy-to-use payout options.

By offering USD-denominated wallet transfers, MasterRemit provides a familiar and widely accepted option for recipients across the Congo DRC.

Here is why USD wallet transfers are beneficial in this region:

– Matches common transaction preferences in Congo DRC.

– Reduces currency conversion friction for recipients.

– Makes it clear what amount of money is coming into the account.

Sending Money to Jordan with MasterRemit

MasterRemit has expanded its Middle East offering to support customers who send money to Jordan through secure bank deposit services. This option is suited to recipients who prefer funds delivered directly to their bank accounts.

Customers who send money from Australia to Jordan can rely on established banking channels that align with local regulatory requirements.

It matters because we support:

– Direct deposits to local bank accounts.

– Secure and regulated delivery.

– Clear transfer tracking from sender to recipient.

This service improves transparency for customers who send money from New Zealand to Jordan to support or have financial commitments in Jordan.

Sending Money to Qatar with MasterRemit

For customers who send money to Qatar, MasterRemit now offers bank deposit transfers designed to simplify the remittance process. This service supports efficient delivery through recognised financial institutions.

Key advantages include:

– Simplified bank transfers aligned with local banking systems.

– Often provides faster access to funds compared to traditional remittance channels.

These improvements help customers maintain consistent financial support with greater ease.

Sending Money to Saudi Arabia with MasterRemit

MasterRemit has introduced mobile wallet transfers for customers who send money to Saudi Arabia, expanding payout flexibility in one of the region’s highest-volume remittance markets.

This service enables customers to send money from Australia to Saudi Arabia using mobile-first delivery methods that suit modern payment preferences.

We now provide:

– Mobile-first access in a high-volume remittance market.

– Convenient alternative to bank-only transfers.

– Faster availability of funds for recipients.

How to Send Money to the New Corridors with MasterRemit

MasterRemit’s platform makes it simple for customers to access the newly opened corridors across Africa and the Middle East. The process remains consistent and easy to follow.

Step-by-Step Overview

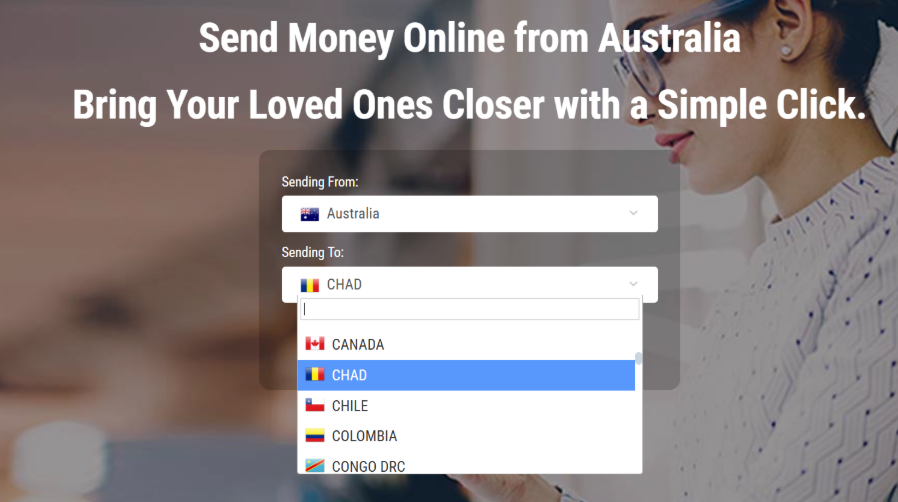

1. Select the destination country

Customers begin by choosing the country they want to send money to from the destination list. Newly added options include Chad, Congo DRC, Jordan, Qatar, and Saudi Arabia.

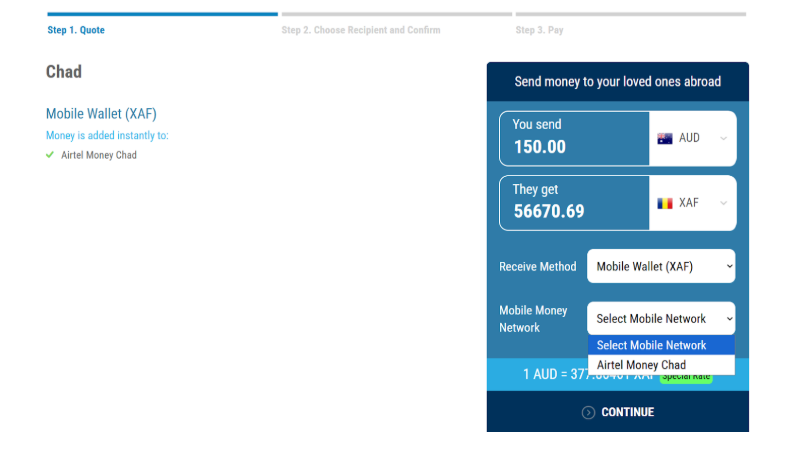

2. Choose the Payout Method

After selecting the destination country, customers choose how the recipient will receive the funds. The available payout methods are displayed automatically based on the selected corridor.

For example, when customers send money to Chad, the platform presents Mobile Wallet (XAF) as the available receiving method.

At this stage, customers:

– Select Mobile Wallet or Bank Deposit, depending on the destination.

– Confirm the supported currency for the transfer.

– Choose the relevant mobile money network or bank option.

Once selected, the platform clearly shows:

– The amount sent in AUD.

– The amount the recipient will receive in the local currency.

– The chosen payout method and network

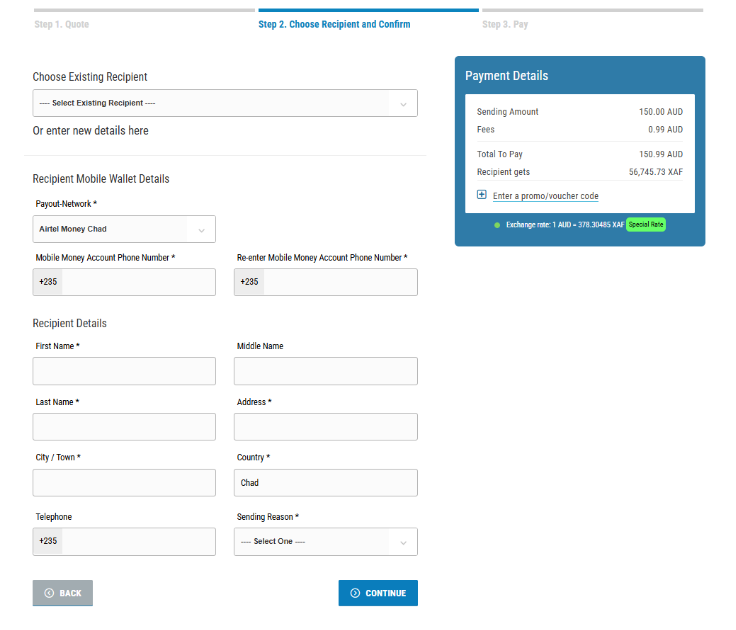

3. Enter the Recipient’s Mobile Wallet or Bank Account Details

After selecting the payout method, customers are prompted to enter the recipient’s account details. The information requested adjusts automatically based on whether the transfer is sent to a mobile wallet or a bank account, ensuring a smooth and accurate setup across all supported corridors.

Customers can:

– Choose an existing recipient from their saved list, or

– Add a new recipient by entering the required details

For mobile wallet transfers, customers enter:

– The selected mobile money network, where applicable.

– The recipient’s registered mobile wallet number.

– A confirmation of the mobile number to prevent errors.

For bank deposit transfers, customers enter:

– The recipient’s bank name.

– The bank account number

– Any additional details required for local processing.

In all cases, basic recipient information is required, including:

– Full name

– Address and city or town

– Destination country (auto-filled)

– Contact number

– Reason for sending

Collecting this information ensures funds are delivered accurately and helps avoid delays when customers send money through newly opened corridors.

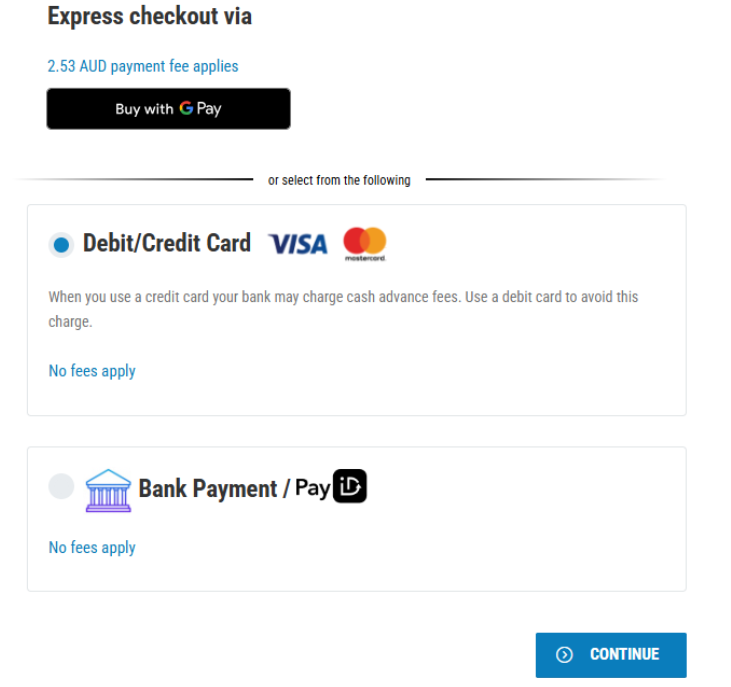

4. Pay Securely and Track Your Transfer

In the final step, customers complete the payment and submit their transfer. MasterRemit offers multiple secure payment options, allowing customers to choose the method that best suits their preferences.

Available payment options may include:

– Debit or credit card

– Bank payment

– Express checkout options, where available

Any applicable fees are clearly displayed before payment is confirmed, ensuring full transparency. Customers can review the total amount to be paid and proceed with confidence.

Once payment is completed:

– The transfer is submitted for processing.

– Customers receive confirmation through their MasterRemit account.

– Transfer status can be tracked from submission through to delivery.

This final step provides reassurance for customers and allows them to monitor progress and confirm that funds reach the recipient as expected.

What Makes This New Feature Special?

MasterRemit’s newly introduced corridors across Africa and the Middle East focus on removing long-standing barriers in international money transfers.

– Fast Payouts

The new corridors support fast and efficient payouts through mobile wallets and local bank networks. Mobile wallet transfers provide quick access to funds for recipients.

Bank deposits are processed efficiently through established local banking systems. This makes sure recipients can access funds quickly for everyday needs.

– Multi-Currency Support

Transfers across the new corridors support multiple regional currencies, including XAF, USD, JOD, QAR, and SAR. This reduces the need for additional currency conversions and improves clarity for both senders and recipients.

– Trusted Local Wallet Networks

MasterRemit partners with well-established mobile wallet providers such as Airtel Money and M-Pesa, which are widely recognised and commonly used platforms. Moreover, these platforms are familiar and trusted by recipients in their local markets.

– Expanded Access Where Options Were Limited

These new corridors open access to destinations where remittance options were previously restricted. It also supports transfers to underserved or underbanked regions and brings down the dependency on informal or unregulated transfer methods.

– Faster Access to Funds for Recipients

Quicker processing means recipients spend less time waiting for funds and thus supports urgent or time-sensitive transfers. It also improves confidence for both senders and recipients.

– Safe and Reliable Transfers

Every transfer follows MasterRemit’s established secure, regulated remittance process, which clearly gives confirmations and transfer tracking.

– Easier Sending Experience

The new feature set simplifies how customers send money, where mobile wallet transfers require minimal account information, and bank deposits follow guided steps.

What to Know About Our Exchange Rates and Fees?

Exchange rates for international money transfers change regularly based on market conditions. For this reason, rates may vary from day to day and between corridors.

MasterRemit provides competitive and real-time exchange rates that are updated at the time of the transfer. Customers can always view the latest applicable rate and any associated fees directly on the website before confirming a transaction.

This makes sure that there is:

– Full visibility of costs before payment

– Transparency without relying on outdated information

– Confidence that customers understand the value of their transfer

Why Choose MasterRemit for Africa and Middle East Transfers?

The latest corridor expansions across Africa and the Middle East reflect a long-term commitment to access and reliability.

Key strengths include:

– Expanding corridor coverage in high-need regions: MasterRemit prioritises destinations where customers previously faced limited payout options, opening access to new markets through a single platform.

– Trusted mobile wallet and banking partnerships: Partnerships with established mobile wallet providers and regulated banking institutions ensure recipients receive funds through familiar and dependable channels.

– Secure and user-friendly platform: Every transfer follows strict compliance standards, while the platform remains simple and intuitive for customers to use.

– Built for speed and accessibility: Fast payouts, clear confirmations, and transfer tracking help customers send money with reassurance and control.

More Countries And More Ways to Stay Connected

Every international transfer is either to support family, help family with daily expenses, or stay connected across borders.

With its newly expanded mobile wallet and bank deposit corridors, MasterRemit is making it easier for customers to reach more countries across Africa and the Middle East through one trusted platform.

These updates reflect MasterRemit’s ongoing commitment to removing barriers, expanding access, and putting customers first.

Explore MasterRemit’s newly expanded corridors and send money safely today.

FAQs

1. Do recipients need a bank account to receive money in Chad or Congo DRC?

No. Recipients do not need a bank account to receive funds in Chad or Congo DRC when the transfer is sent to a supported mobile wallet. Funds are delivered directly to the recipient’s registered mobile wallet, making access easier in regions where banking access is limited.

2. Are there limits on how much money can be sent to Chad or the Congo DRC?

Yes. Transfer limits may apply depending on the destination country, payout method, and regulatory requirements. Customers can view applicable limits during the transfer process on masterremit.com before confirming a transaction.

3. What happens if the recipient’s mobile wallet details are incorrect?

If the mobile wallet details are incorrect, the transfer may be delayed or unsuccessful. Customers are encouraged to carefully review recipient information before confirming the transfer. In most cases, MasterRemit’s support team can assist in resolving the issue where possible.

4. Can recipients withdraw cash from their mobile wallet after receiving funds?

Yes. In many cases, recipients can withdraw cash from their mobile wallet through authorised agents, subject to the mobile wallet provider’s rules and local availability. Recipients may also use the funds digitally, where supported.

5. Is customer support available if there is an issue with the transfer?

Yes. MasterRemit provides customer support to assist with transfer-related questions or issues. Customers can contact support through the channels listed on masterremit.com for timely assistance.

6. Do recipients need a bank account to receive money through MasterRemit?

It depends on the selected payout method. Mobile wallet transfers do not require a bank account, while bank deposit transfers require the recipient to have a valid local bank account in the destination country.

7. How long do transfers to mobile wallets usually take?

Transfers to mobile wallets are often processed quickly and may be completed within a short period. Actual delivery times can vary depending on the destination, mobile wallet network, and verification requirements.

8. Are these new corridors available to both new and existing MasterRemit users?

Yes. The newly introduced corridors are available to both new and existing MasterRemit customers, subject to standard verification and compliance checks.

9. Can recipients use funds directly from their mobile wallet without withdrawing cash?

Yes. Where supported by the mobile wallet provider, recipients can use funds directly from their mobile wallet for payments, transfers, or other services without withdrawing cash.

10. What verification is required to send money to these countries?

Customers may be required to complete identity verification depending on the destination, transfer amount, and regulatory requirements. Verification steps are clearly outlined during the transfer process.

11. Are these services available 24/7?

Customers can initiate transfers at any time through MasterRemit’s online platform. Processing times may vary depending on the destination, payout method, and local partner availability.

12. What happens if a transfer is delayed or fails?

If a transfer is delayed or unsuccessful, customers can track the status through their MasterRemit account. The support team is available to provide updates and assist with next steps where required.